- #FREE BOOKKEEPING SOFTWARE FOR FREE#

- #FREE BOOKKEEPING SOFTWARE HOW TO#

- #FREE BOOKKEEPING SOFTWARE PRO#

- #FREE BOOKKEEPING SOFTWARE SOFTWARE#

This is software that automatically connects your back account to import expenses with the added tax write-off. With Bonsai, you get accounting software that performs a ton of imperative financial operations. Here are the details of the different FreshBooks packages:īest for Small businesses and freelancers.

#FREE BOOKKEEPING SOFTWARE FOR FREE#

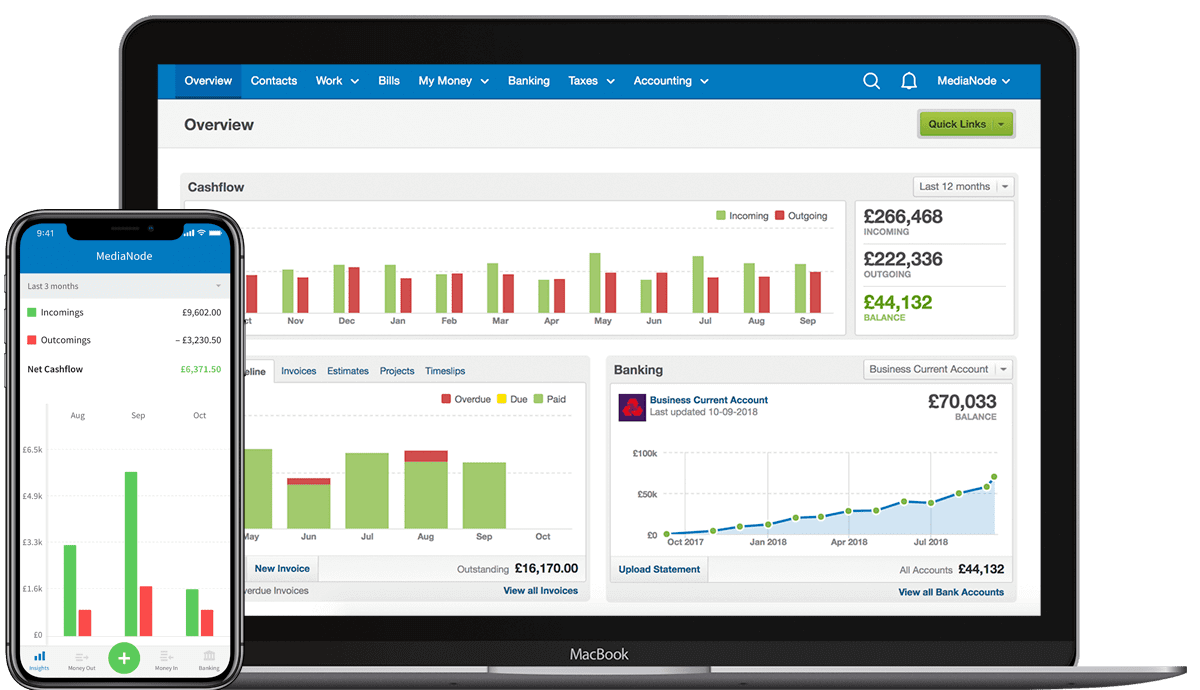

You can try the software for free for up to 30 days. You can select Lite ($6 per month), Plus ($10 per month), Premium ($20 per month), and custom packages. Price: FreshBooks is available in different packages. It is also affordably priced for businesses and self-employed individuals. The application has all the basic features required for managing the software. Verdict: FreshBooks is simple-to-use accounting software. There are lots of features for recording, monitoring, and managing expenses and invoices.įurther reading => FreshBooks vs QuickBooks – A ComparisonĬons: Lack of inventory management features. Review of business accounting software: #1) FreshBooksīest for independent contractors and business owners.įreshBooks is affordable accounting software for businesses and self-employed individuals.

#FREE BOOKKEEPING SOFTWARE PRO#

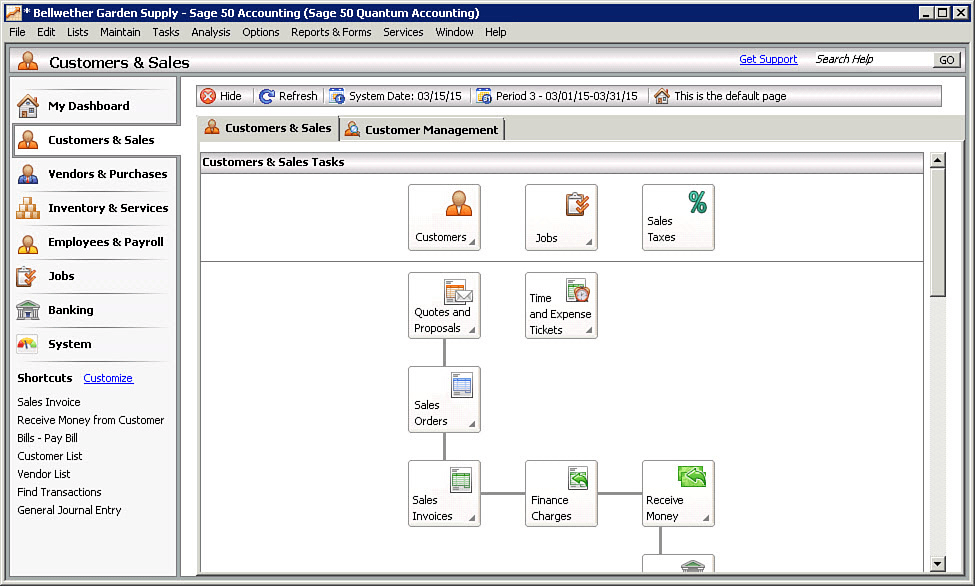

Pro Accounting ($50.58 per month), Premium($78.25 per month), Quantum Accounting ($131.66 per month) Starter ($19 per month), Rookie ($37 per month), Pro ($57 per month), and Advanced ($79 per month).īasic and advanced accounting for small and medium sized businesses. Starter ($20 per month), Standard ($30 per month), and Premium ($40 per month)īasic accounting and expense tracking for small business owners. Invoice, accounts, and cashflow management for free.

Standard approval workflows, log payment-related activities, etc. Smart AP and AR automation and new bill payment capabilities. It starts at $15 per organization per month.Īccounting, invoicing, inventory management, & taxation for self-employed & small to midsize businesses. Invoicing & expenses, Tax payments, inventory, etc.

(Billed Annually).īusiness owners who want to track expenses & automate workflows. Starter plan: $17 per month, Professional plan: $32/month, Business plan: $52/month. Lite ($6 per month), Plus ($10 per month), Premium ($20 per month) Independent contractors and small business owners. If you have a touch screen, you can touch the screen and enter fields using the keyboard. Accounting software allows you to enter transactions using a keyboard and mouse.

#FREE BOOKKEEPING SOFTWARE HOW TO#

Q #4) How to use an accounting application?Īnswer: Anyone that knows how to use a windows application can use accounting software.

Suggested reading => Top Financial Consolidation Software It allows business owners to focus on more important aspects of running the business. The software can automatically generate accounting data. Q #3) What are the benefits of accounting software?Īnswer: Using an accounting application saves time in managing financial data. The main features of an accounting app include invoices, expense management, tax calculation, and bank reconciliation. Q #2) What are the features of accounting software?Īnswer: These come with different features. You can print reports to get a snapshot of the financial position of your company at a particular period. The software saves time and effort in managing expenses and revenues. Frequently Asked QuestionsĪnswer: An accounting application is used for recording financial transactions. Download a trial version if available to test the software before purchasing it. You should select an accounting app with features that meet your requirements. Pro-Tip: Different accounting app has features that are designed for specific users.

0 kommentar(er)

0 kommentar(er)